Peerless Tips About How To Reduce Withholding Tax

Use the same tax forms you used the previous year, but substitute this year's tax.

How to reduce withholding tax. Visit the irs’s withholding online calculator. Check with your local tax. Continue through the screens, entering the.

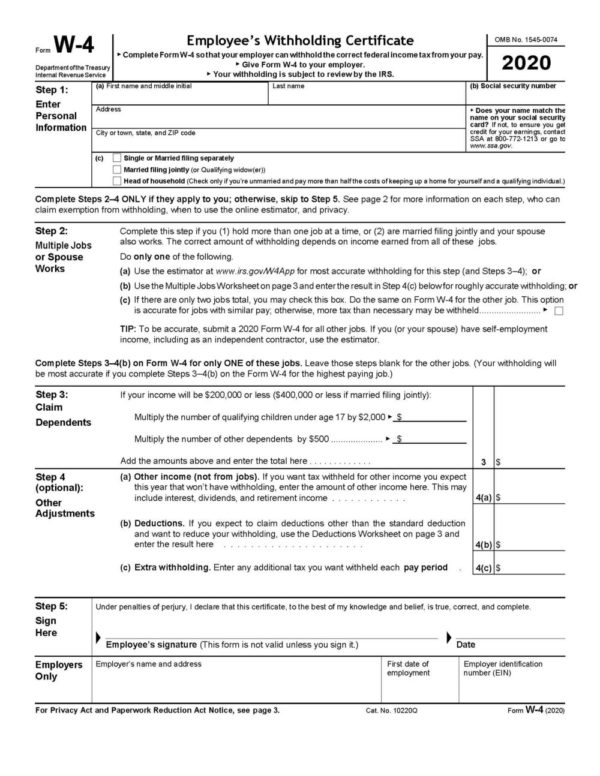

To register your tax residence and apply a reduced tax withholding rate on your mintos account, we are required to receive a tax resident certificate from you. Visit the irs website at irs.gov and navigate to the withholdings calculator. Use the irs tax withholding estimator to complete the form, then submit it to the payroll department where you work.

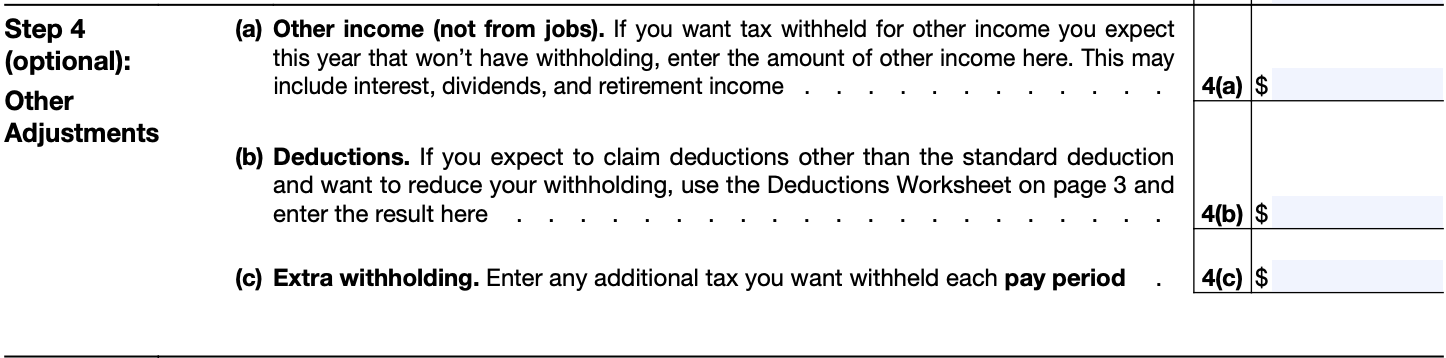

Now, here’s where that “making money” thing comes in. One way to adjust your withholding is to prepare a projected tax return for the year. How to reduce tax withholding step 1.

Enter your information in the calculator and determine your. Taxpayers with more complex situations may need to use publication 505 instead of the tax. Use the instructions in publication 505, tax withholding and estimated tax.

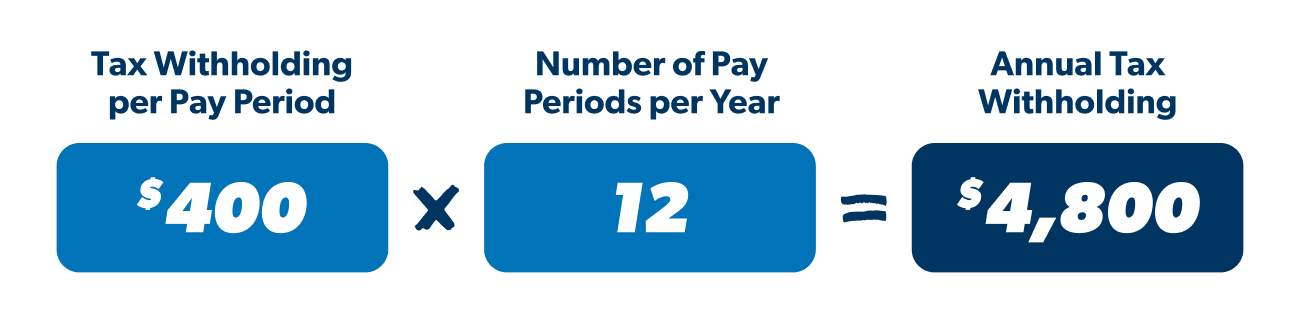

That’s a ballpark figure for how much extra you could earn, every month. This is better for taxpayers that still have. To change your tax withholding, use the results from the withholding estimator to determine if you should:

Add up this year’s tax refund and divide by 12. To reduce tax withholding, an employee must increase their number of withholding allowances.

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)