Stunning Tips About How To Reduce Interest Expense

If possible, keep track of small costs that use petty cash.

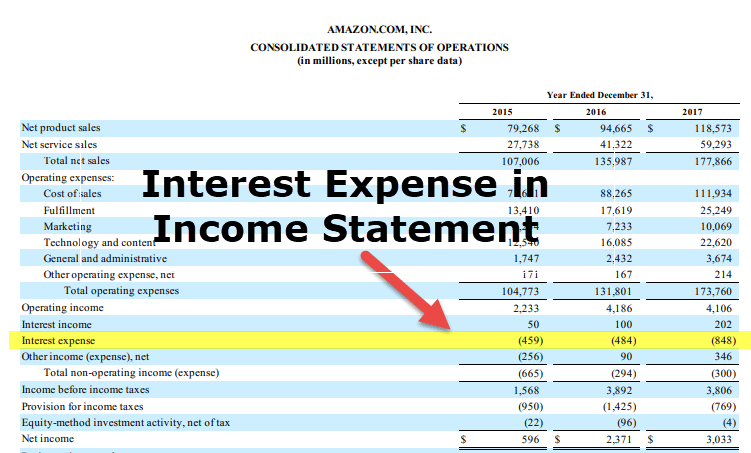

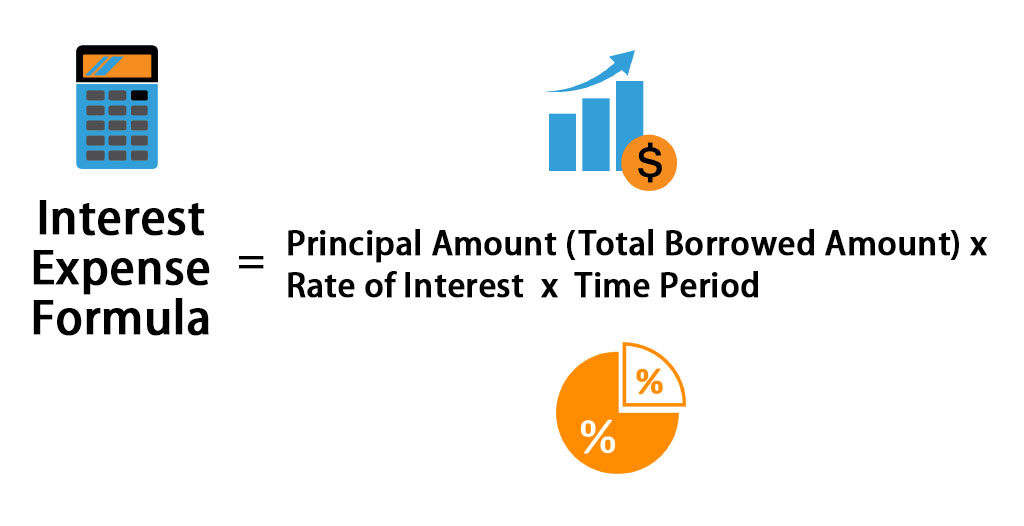

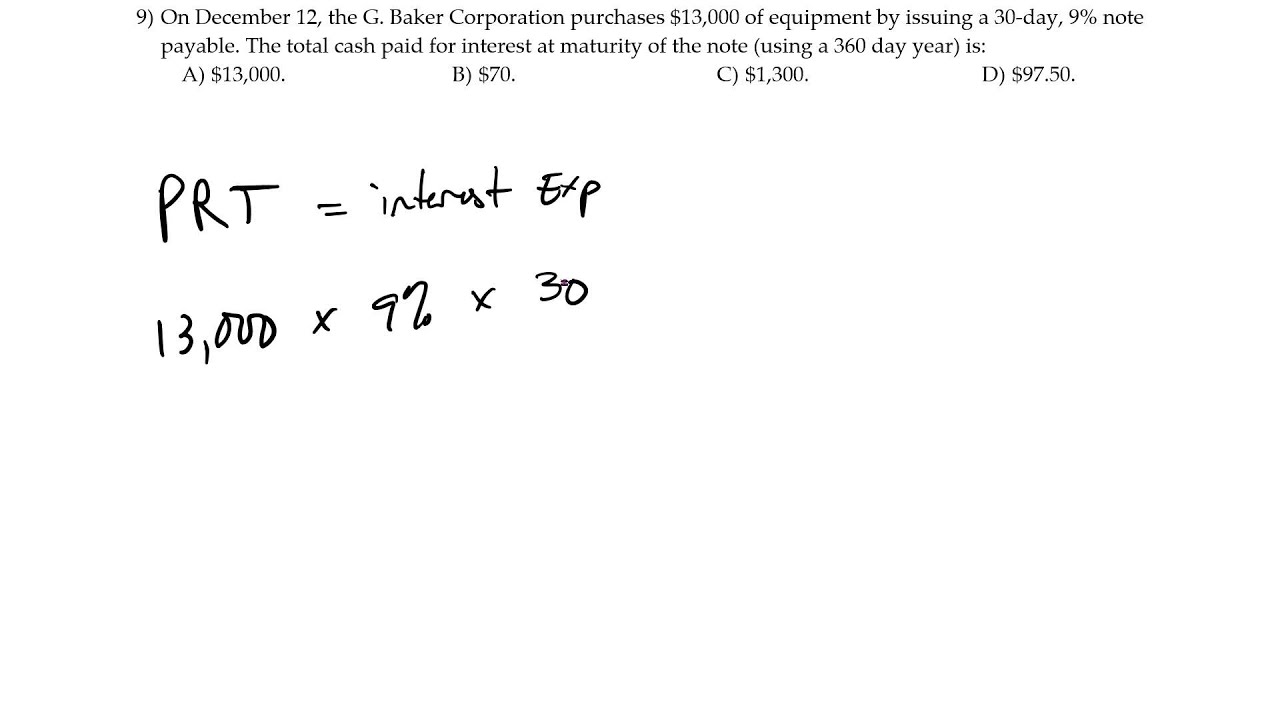

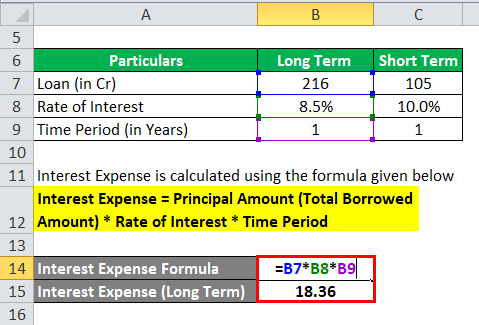

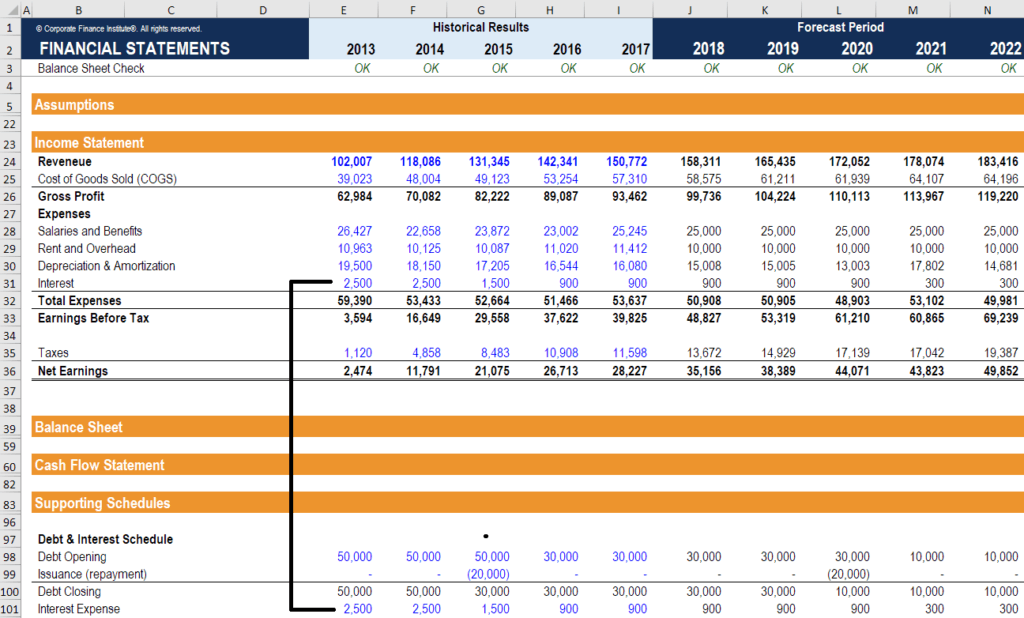

How to reduce interest expense. You can do some cost cutting on office supplies by shopping around to compare prices. The interest expense formula is: Break down the intake operations for new loan applications, such as home equity, mortgage, and consumer loans.

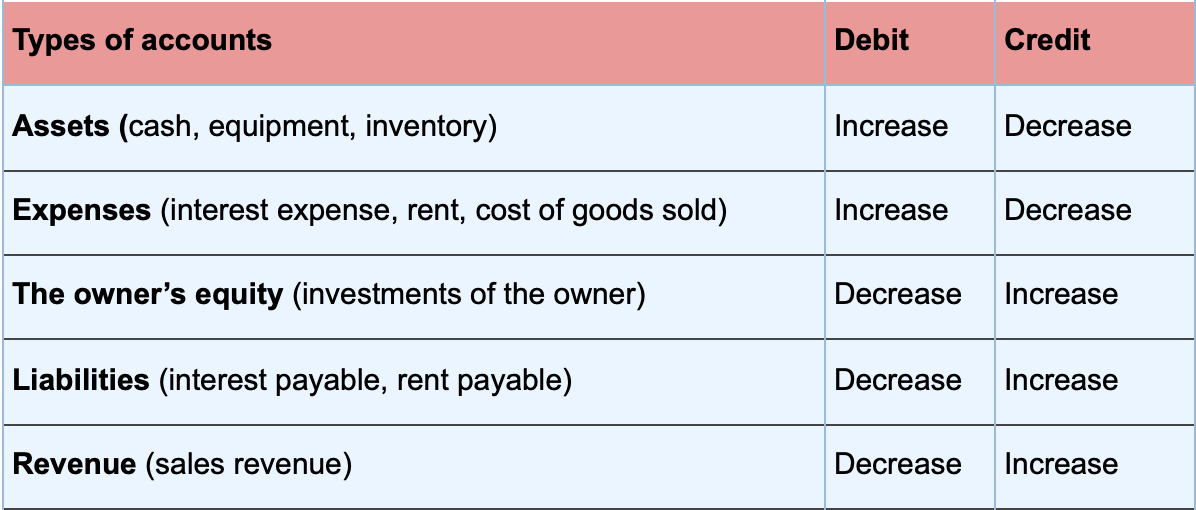

The amount of interest incurred is typically expressed as a percentage of the outstanding amount of principal. C) reduce (debit) the finance lease liability account for the difference. Look outside your pool of traditional vendors.

The irs says that when you prepay interest, you must allocate the interest over the tax years to which the interest applies. You may deduct in each year only the interest that. Investment interest is paid on a loan that you used to purchase an investment property or other dividends, interest, royalties, or annuities.

If you have credit card debt on multiple cards, some personal. Business interest income for the tax year;. For tax years beginning after 2017, the deduction for business interest expense cannot exceed the sum of the taxpayer's:

A) reverse the previous 11 months of interest accrued. Having a 3 square meal at. Fixed operating costs that a financial institution must incur, such as anticipated bad debt provisions.

It is more economical when you cook at home. Those small amounts can quickly add. Noninterest expenses can include employee salaries.